Weekly Tax Brief

Holiday parties and gifts can help show your appreciation and provide tax breaks

- Details

- Published: 06 December 2019 06 December 2019

The holiday season is in full swing. Your business may want to show its gratitude to employees and customers by giving them gifts or hosting parties. It’s a good idea to understand the tax rules involved. Are they tax deductible by your business and taxable to the recipients? Gifts to customers are generally deductible up to $25 per recipient per year. De minimis, noncash gifts to employees (such as a holiday turkey) aren’t included in their taxable income yet are deductible by you. Holiday parties are 100% deductible if they’re primarily for the benefit of non-highly-paid employees and their families. If customers attend, parties may be partially deductible. Contact us with questions.

Read more: Holiday parties and gifts can help show your appreciation and provide tax breaks

What is your taxpayer filing status?

- Details

- Published: 02 December 2019 02 December 2019

When you file your tax return, you do so with one of five filing statuses. It’s possible that more than one status will apply. The box checked on your return generally depends in part on whether you’re unmarried or married on December 31. Here are the filing statuses: Single, married filing jointly, married filing separately, head of household and qualifying widow(er) with a dependent child. Head of household status can be more favorable than filing as a single person, but special rules apply. You must generally be unmarried, have a qualifying child (or dependent relative) and meet certain rules involving “maintaining a household.” If you have questions about your filing status, contact us.

The tax implications if your business engages in environmental cleanup

- Details

- Published: 27 November 2019 27 November 2019

If your company needs to “remediate” or clean up environmental contamination, the expenses involved can be tax deductible. Unfortunately, every type of environmental cleanup expense cannot be currently deducted. Some cleanup costs must be capitalized. For example, remediation costs generally have to be capitalized if the remediation adds significantly to the value of the cleaned-up property; prolongs the useful life of the property; or adapts it to a new or different use. In addition to federal tax deductions, there may be state or local tax incentives involved in cleaning up contaminated property. If you have environmental cleanup expenses, we can help maximize the deductions available.

Read more: The tax implications if your business engages in environmental cleanup

Using your 401(k) plan to save this year and next

- Details

- Published: 25 November 2019 25 November 2019

Does your employer offer a 401(k) or Roth 401(k) plan? Contributing to it is a taxwise way to build a nest egg. If you’re not already socking away the maximum allowed, consider increasing your contribution between now and year end. With a 401(k), an employee elects to have a certain amount of pay deferred and contributed by an employer on his or her behalf to the plan. The contribution limit for 2019 is $19,000. Employees age 50 or older by year end are also permitted to make additional “catch-up” contributions of $6,000, for a total limit of $25,000 in 2019.

Read more: Using your 401(k) plan to save this year and next

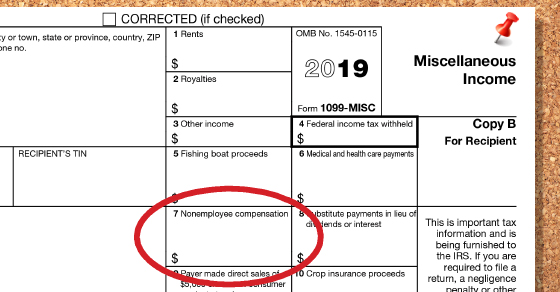

Small businesses: Get ready for your 1099-MISC reporting requirements

- Details

- Published: 22 November 2019 22 November 2019

Early next year, your business may be required to comply with Form 1099 rules. You may have to send forms to independent contractors, vendors and others whom you pay nonemployee compensation, as well as file them with the IRS. There are penalties for noncompliance. Employers must provide a Form 1099-MISC for nonemployee compensation by Jan. 31, 2020, to each noncorporate service provider who was paid at least $600 for services during 2019. (1099-MISCs generally don’t have to be provided to corporate service providers.) A copy of each Form 1099-MISC with payments listed in box 7 must also be filed with the IRS by Jan. 31. If you have questions about your reporting requirements, contact us.

Read more: Small businesses: Get ready for your 1099-MISC reporting requirements

You may be ABLE to save for a disabled family member with a tax-advantaged account

- Details

- Published: 18 November 2019 18 November 2019

There’s a tax-advantaged way for people to save for the needs of family members with disabilities, without having them lose eligibility for government benefits to which they’re entitled. It’s done though an ABLE account, which is a tax-free account that can be used for disability-related expenses. ABLE accounts can be created by eligible individuals to support themselves, by family members to support their dependents, or by guardians. Contributions up to the annual gift-tax exclusion amount, currently $15,000, can be made to an account each year. If the beneficiary works, he or she can also contribute some income to their ABLE account. Contact us if you’d like more details.

Read more: You may be ABLE to save for a disabled family member with a tax-advantaged account

Small businesses: Stay clear of a severe payroll tax penalty

- Details

- Published: 15 November 2019 15 November 2019

Managing payroll is a laborious task for small businesses. But it’s critical to withhold the right amount of taxes from employees and pay them over to the federal government on time. If you don’t, you could be hit with the Trust Fund Recovery Penalty, also known as the 100% penalty. It applies to the Social Security and income taxes required to be withheld by a business from its employees’ wages. It’s called the 100% penalty because people liable or responsible for the taxes can be personally penalized 100% of the taxes due. Absolutely no failure to withhold and no “borrowing” from withheld amounts should ever be allowed in your business. Contact us for more information.

Read more: Small businesses: Stay clear of a severe payroll tax penalty

IRA charitable donations are an alternative to taxable required distributions

- Details

- Published: 12 November 2019 12 November 2019

Are you charitably minded and have a significant amount of money in an IRA? If you’re age 70-1/2 or older, and don’t need the money from required minimum distributions, you may benefit by giving these amounts to charity. Contact us for more information.

Read more: IRA charitable donations are an alternative to taxable required distributions

Thinking about converting from a C corporation to an S corporation?

- Details

- Published: 08 November 2019 08 November 2019

The right entity choice can make a difference in the taxes you owe for your business. Although S corporations can provide substantial tax advantages over C corporations in some situations, there are potential tax problems you should assess before deciding to convert from C to S status. One of the issues to consider is last-in, first-out (LIFO) inventory. A C corporation that uses LIFO inventory must pay tax on the benefits it derived by using LIFO if it converts to an S corporation. Other issues to understand are the built-in gains tax, passive income tax and unused net operating losses. We can explain how these factors will affect your company and develop strategies to minimize taxes.

Read more: Thinking about converting from a C corporation to an S corporation?

Selling securities by year end? Avoid the wash sale rule

- Details

- Published: 04 November 2019 04 November 2019

If you’re planning to sell assets at a loss to offset gains that have been realized during the year, it’s important to be aware of the “wash sale” rule. Under this rule, if you sell stock or securities for a loss and buy substantially identical stock or securities back within the 30-day period before or after the sale date, the loss can’t be claimed for tax purposes. The rule is designed to prevent taxpayers from using the tax benefit of a loss without parting with ownership in a significant way. Note that the rule applies to a 30-day period before or after the sale date to prevent “buying the stock back” before it’s even sold. Contact us if you have any questions.

Read more: Selling securities by year end? Avoid the wash sale rule