Recent Articles

The TCJA temporarily expands bonus depreciation

- Details

- Published: 23 January 2018 23 January 2018

The Tax Cuts and Jobs Act (TCJA) enhances some tax breaks for businesses while reducing or eliminating others. One break it enhances — temporarily — is bonus depreciation. While most TCJA provisions go into effect for the 2018 tax year, you might be able to benefit from the bonus depreciation enhancements when you file your 2017 tax return.

Tax Cuts and Jobs Act: Key provisions affecting businesses

- Details

- Published: 23 January 2018 23 January 2018

The recently passed tax reform bill, commonly referred to as the “Tax Cuts and Jobs Act” (TCJA), is the most expansive federal tax legislation since 1986. It includes a multitude of provisions that will have a major impact on businesses.

Which tax-advantaged health account should be part of your benefits package?

- Details

- Published: 23 January 2018 23 January 2018

On October 12, an executive order was signed that, among other things, seeks to expand Health Reimbursement Arrangements (HRAs). HRAs are just one type of tax-advantaged account you can provide your employees to help fund their health care expenses. Also available are Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). Which one should you include in your benefits package?

Your 2017 tax return may be your last chance to take the “manufacturers’ deduction”

- Details

- Published: 23 January 2018 23 January 2018

While many provisions of the Tax Cuts and Jobs Act (TCJA) will save businesses tax, the new law also reduces or eliminates some tax breaks for businesses.

Personal exemptions and standard deductions and tax credits, oh my!

- Details

- Published: 23 January 2018 23 January 2018

Under the Tax Cuts and Jobs Act (TCJA), individual income tax rates generally go down for 2018 through 2025. But that doesn’t necessarily mean your income tax liability will go down.

Five Things to Remember about Hobby Income and Expenses

- Details

- Published: 21 November 2017 21 November 2017

From scrapbooking to glass blowing, many Americans enjoy hobbies that are also a source of income. A taxpayer must report income on their tax return even if it is made from a hobby.

How to determine if you need to worry about estate taxes

- Details

- Published: 21 November 2017 21 November 2017

Among the taxes that are being considered for repeal as part of tax reform legislation is the estate tax. This tax applies to transfers of wealth at death, hence why it’s commonly referred to as the “death tax.” Its sibling, the gift tax — also being considered for repeal — applies to transfers during life. Yet most taxpayers won’t face these taxes even if the taxes remain in place.

2018 Social Security Changes

- Details

- Published: 19 October 2017 19 October 2017

SOCIAL SECURITY FACT SHEET

Updated Form I-9

- Details

- Published: 18 September 2017 18 September 2017

Attention Employers: Beginning Monday, September 18, 2017, employers are required to begin using the new version of Form I-9 for each new employee.

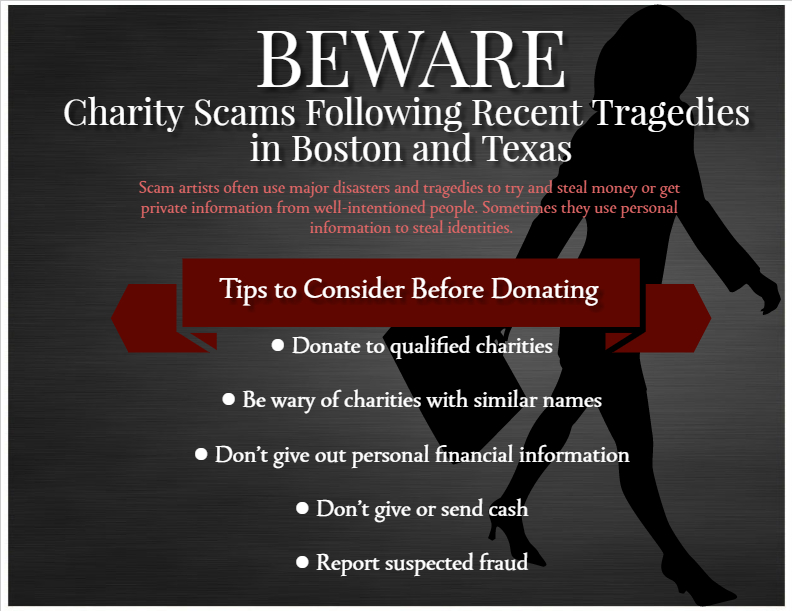

Beware of Charity Scams Following Recent Tragedies in Boston and Texas

- Details

- Published: 08 September 2017 08 September 2017

Scam artists often use major disasters and tragedies to try and steal money or get private information from well-intentioned people. Sometimes they use personal information to steal identities.