Weekly Tax Brief

It’s possible (but not easy) to claim a medical expense tax deduction

- Details

- Published: 04 January 2024 04 January 2024

One of your New Year’s resolutions may be to pay more attention to your health. Of course, that may cost you. Can you deduct your out-of-pocket medical costs on your tax return? It depends. Many expenses are tax deductible, but there are several requirements and limitations that make it difficult for many taxpayers to actually claim a deduction.

The rules

Medical expenses can be claimed as a deduction only to the extent your unreimbursed costs exceed 7.5% of your adjusted gross income. Plus, medical expenses are deductible only if you itemize, which means that your itemized deductions must exceed your standard deduction. Due to changes in the Tax Cuts and Jobs Act, which generally went into effect in 2018, many taxpayers no longer itemize.

Eligible medical costs include many expenses other than hospital and doctor bills. Here are some items to take into account when determining a possible deduction:

Transportation. The cost of getting to and from medical treatment is an eligible expense. This includes taxi fares, public transportation or using your own vehicle. Car costs can be calculated at 21 cents per mile for miles driven in 2024 (down from 22 cents in 2023), plus tolls and parking. Alternatively, you can deduct your actual costs, including gas and oil, but not general costs such as insurance, depreciation or maintenance.

Insurance premiums. The cost of health insurance is a medical expense that can total thousands of dollars a year. Even if your employer provides you with coverage, you can deduct the portion of the premiums you pay. Long-term care insurance premiums also qualify, subject to dollar limits based on age.

Therapists and nurses. Services provided by individuals other than physicians can qualify if they relate to a medical condition and aren’t for general health. For example, the cost of physical therapy after knee surgery does qualify, but the cost of a personal trainer to help you get in shape doesn’t. Also qualifying are amounts paid for acupuncture and those paid to a psychologist for medical care. In addition, certain long-term care services required by chronically ill individuals are eligible.

Eyeglasses, hearing aids, dental work and prescriptions. Deductible expenses include the cost of glasses, contacts, hearing aids, dentures and most dental work. Purely cosmetic expenses (such as teeth whitening) don’t qualify, but certain medically necessary cosmetic surgery is deductible. Prescription drugs qualify, but nonprescription drugs such as aspirin don’t, even if a physician recommends them. Neither do amounts paid for treatments that are illegal under federal law (such as marijuana), even if permitted under state law.

Smoking-cessation programs. Amounts paid to participate in a smoking-cessation program and for prescribed drugs designed to alleviate nicotine withdrawal are deductible expenses. However, nonprescription gum and certain nicotine patches aren’t.

Weight-loss programs. A weight-loss program is a deductible expense if undertaken as treatment for a disease diagnosed by a physician. This could be obesity or another disease, such as hypertension, for which a doctor directs you to lose weight. It’s a good idea to get a written diagnosis. In these cases, deductible expenses include fees paid to join a weight-loss program and attend meetings. However, the cost of low-calorie food that you eat in place of a regular diet isn’t deductible.

Dependents and others. You can deduct the medical expenses you pay for dependents, such as your children. Additionally, you may be able to deduct medical costs you pay for an individual, such as a parent or grandparent, who would qualify as your dependent except that he or she has too much gross income or files jointly. In most cases, the medical costs of a child of divorced parents can be claimed by the parent who pays them.

Track eligible costs

As you can see, for deduction purposes, many expenses are eligible. Keep track of your outlays and we’ll determine if you qualify for a deduction when we prepare your tax return.

© 2024

Defer a current tax bill with a like-kind exchange

- Details

- Published: 03 January 2024 03 January 2024

If you’re interested in selling commercial or investment real estate that has appreciated significantly, one way to defer a tax bill on the gain is with a Section 1031 “like-kind” exchange. With this transaction, you exchange the property rather than sell it. Although the real estate market has been tough recently in some locations, there are still profitable opportunities (with high resulting tax bills) when the like-kind exchange strategy may be attractive.

A like-kind exchange is any exchange of real property held for investment or for productive use in your trade or business (relinquished property) for like-kind investment, trade or business real property (replacement property).

For these purposes, like-kind is broadly defined, and most real property is considered to be like-kind with other real property. However, neither the relinquished property nor the replacement property can be real property held primarily for sale.

Asset-for-asset or boot

Under the Tax Cuts and Jobs Act, tax-deferred Section 1031 treatment is no longer allowed for exchanges of personal property — such as equipment and certain personal property building components — that are completed after December 31, 2017.

If you’re unsure if the property involved in your exchange is eligible for like-kind treatment, please contact us to discuss the matter.

Assuming the exchange qualifies, here’s how the tax rules work. If it’s a straight asset-for-asset exchange, you won’t have to recognize any gain from the exchange. You’ll take the same “basis” (your cost for tax purposes) in the replacement property that you had in the relinquished property. Even if you don’t have to recognize any gain on the exchange, you still must report it on Form 8824, “Like-Kind Exchanges.”

However, in many cases, the properties aren’t equal in value, so some cash or other property is added to the deal. This cash or other property is known as “boot.” If boot is involved, you’ll have to recognize your gain, but only up to the amount of boot you receive in the exchange. In these situations, the basis you get in the like-kind replacement property you receive is equal to the basis you had in the relinquished property reduced by the amount of boot you received but increased by the amount of any gain recognized.

How it works

For example, let’s say you exchange business property with a basis of $100,000 for a building valued at $120,000, plus $15,000 in cash. Your realized gain on the exchange is $35,000: You received $135,000 in value for an asset with a basis of $100,000. However, since it’s a like-kind exchange, you only have to recognize $15,000 of your gain. That’s the amount of cash (boot) you received. Your basis in the new building (the replacement property) will be $100,000: your original basis in the relinquished property ($100,000) plus the $15,000 gain recognized, minus the $15,000 boot received.

Note that no matter how much boot is received, you’ll never recognize more than your actual (“realized”) gain on the exchange.

If the property you’re exchanging is subject to debt from which you’re being relieved, the amount of the debt is treated as boot. The reason is that if someone takes over your debt, it’s equivalent to the person giving you cash. Of course, if the replacement property is also subject to debt, then you’re only treated as receiving boot to the extent of your “net debt relief” (the amount by which the debt you become free of exceeds the debt you pick up).

Unload one property and replace it with another

Like-kind exchanges can be a great tax-deferred way to dispose of investment, trade or business real property. But you have to make sure to meet all the requirements. Contact us if you have questions or would like to discuss the strategy further.

© 2024

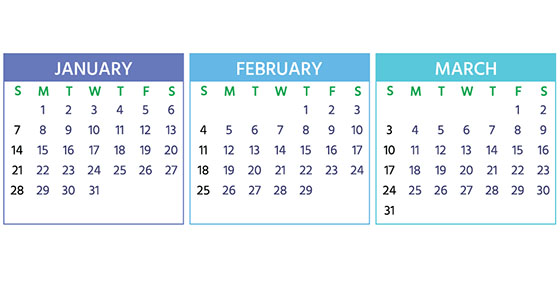

2024 Q1 tax calendar: Key deadlines for businesses and other employers

- Details

- Published: 19 December 2023 19 December 2023

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. If you have questions about filing requirements, contact us. We can ensure you’re meeting all applicable deadlines.

January 16 (The usual deadline of January 15 is a federal holiday)

- Pay the final installment of 2023 estimated tax.

- Farmers and fishermen: Pay estimated tax for 2023. If you don’t pay your estimated tax by January 16, you must file your 2023 return and pay all tax due by March 1, 2024, to avoid an estimated tax penalty.

January 31

- File 2023 Forms W-2, “Wage and Tax Statement,” with the Social Security Administration and provide copies to your employees.

- Provide copies of 2023 Forms 1099-NEC, “Nonemployee Compensation,” to recipients of income from your business, where required, and file them with the IRS.

- Provide copies of 2023 Forms 1099-MISC, “Miscellaneous Information,” reporting certain types of payments to recipients.

- File Form 940, “Employer’s Annual Federal Unemployment (FUTA) Tax Return,” for 2023. If your undeposited tax is $500 or less, you can either pay it with your return or deposit it. If it’s more than $500, you must deposit it. However, if you deposited the tax for the year in full and on time, you have until February 12 to file the return.

- File Form 941, “Employer’s Quarterly Federal Tax Return,” to report Medicare, Social Security and income taxes withheld in the fourth quarter of 2023. If your tax liability is less than $2,500, you can pay it in full with a timely filed return. If you deposited the tax for the quarter in full and on time, you have until February 12 to file the return. (Employers that have an estimated annual employment tax liability of $1,000 or less may be eligible to file Form 944, “Employer’s Annual Federal Tax Return.”)

- File Form 945, “Annual Return of Withheld Federal Income Tax,” for 2023 to report income tax withheld on all nonpayroll items, including backup withholding and withholding on accounts such as pensions, annuities and IRAs. If your tax liability is less than $2,500, you can pay it in full with a timely filed return. If you deposited the tax for the year in full and on time, you have until February 12 to file the return.

February 15

- Give annual information statements to recipients of certain payments you made during 2023. You can use the appropriate version of Form 1099 or other information return. Form 1099 can be issued electronically with the consent of the recipient. This due date applies only to the following types of payments:

- All payments reported on Form 1099-B.

- All payments reported on Form 1099-S.

- Substitute payments reported in box 8 or gross proceeds paid to an attorney reported in box 10 of Form 1099-MISC.

February 28

- File 2023 Forms 1099-MISC with the IRS if you’re filing paper copies. (Otherwise, the filing deadline is April 1.)

March 15

- If a calendar-year partnership or S corporation, file or extend your 2023 tax return and pay any tax due. If the return isn’t extended, this is also the last day to make 2023 contributions to pension and profit-sharing plans.

© 2023

The “nanny tax” must be paid for nannies and other household workers

- Details

- Published: 14 December 2023 14 December 2023

You may have heard of the “nanny tax.” But if you don’t employ a nanny, you may think it doesn’t apply to you. Check again. Hiring a housekeeper, gardener or other household employee (who isn’t an independent contractor) may make you liable for federal income and other taxes. You may also have state tax obligations.

If you employ a household worker, you aren’t required to withhold federal income taxes from pay. However, you may choose to withhold if the worker requests it. In that case, ask the worker to fill out a Form W-4. However, you may be required to withhold Social Security and Medicare (FICA) taxes and to pay federal unemployment (FUTA) tax.

Threshold increasing in 2024

In 2023, you must withhold and pay FICA taxes if your household worker earns cash wages of $2,600 or more (excluding the value of food and lodging). If you reach the threshold, all the wages (not just the excess) are subject to FICA. In 2024, the threshold will increase to $2,700.

However, if a nanny is under age 18 and child care isn’t his or her principal occupation, you don’t have to withhold FICA taxes. So, if you have a part-time babysitter who is a student, there’s no FICA tax liability.

Both an employer and a household worker may have FICA tax obligations. As an employer, you’re responsible for withholding your worker’s FICA share. In addition, you must pay a matching amount. FICA tax is divided between Social Security and Medicare. The Social Security tax rate is 6.2% for the employer and 6.2% for the worker (12.4% total). Medicare tax is 1.45% each for both the employer and the worker (2.9% total).

If you want, you can pay your worker’s share of Social Security and Medicare taxes. If you do, your payments aren’t counted as additional cash wages for Social Security and Medicare purposes. However, your payments are treated as additional income to the worker for federal tax purposes, so you must include them as wages on the W-2 form that you provide.

You also must pay FUTA tax if you pay $1,000 or more in cash wages (excluding food and lodging) to your worker in any calendar quarter. FUTA tax applies to the first $7,000 of wages paid and is only paid by the employer.

Reporting and paying

You pay household worker obligations by increasing your quarterly estimated tax payments or increasing withholding from wages, rather than making an annual lump-sum payment.

As a household worker employer, you don’t have to file employment tax returns, even if you’re required to withhold or pay tax (unless you own your own business). Instead, employment taxes are reported on your tax return on Schedule H.

When you report the taxes on your return, you include your employer identification number (EIN), which is not the same as your Social Security number. You must file Form SS-4 to get one.

However, if you own a business as a sole proprietor, you include the taxes for a household worker on the FUTA and FICA forms (940 and 941) that you file for your business. And you use your sole proprietorship EIN to report the taxes.

Keep meticulous records

Keep related tax records for at least four years from the later of the due date of the return or the date the tax was paid. Records should include the worker’s name, address, Social Security number, employment dates, dates and amount of wages paid and taxes withheld, and copies of forms filed.

If you need assistance or have questions about how to comply with these employment tax requirements, contact us.

© 2023

Giving gifts and throwing parties can help show gratitude and provide tax breaks

- Details

- Published: 13 December 2023 13 December 2023

The holiday season is here. During this festive season, your business may want to show its gratitude to employees and customers by giving them gifts or hosting holiday parties. It’s a good time to review the tax rules associated with these expenses. Are they tax deductible by your business and is the value taxable to the recipients?

Employee gifts

Many businesses want to show their employees appreciation during the holiday time. In general, anything of value that you transfer to an employee is included in his or her taxable income (and, therefore, subject to income and payroll taxes) and deductible by your business.

But there’s an exception for noncash gifts that constitute a “de minimis” fringe benefit. These are items small in value and given so infrequently that they are administratively impracticable to account for. Common examples include holiday turkeys or hams, gift baskets, occasional sports or theater tickets (but not season tickets), and other low-cost merchandise.

De minimis fringe benefits aren’t included in your employees’ taxable income yet they’re still deductible by your business. Unlike gifts to customers, there’s no specific dollar threshold for de minimis gifts. However, many businesses use an informal cutoff of $75.

Key point: Cash gifts — as well as cash equivalents, such as gift cards — are included in an employee’s income and subject to payroll tax withholding regardless of how small they are and infrequently they’re given.

Customer gifts

If you make gifts to customers or clients, they’re only deductible up to $25 per recipient, per year. For purposes of the $25 limit, you don’t need to include “incidental” costs that don’t substantially add to the gift’s value, such as engraving, gift wrapping, packaging or shipping. Also excluded from the $25 limit is branded marketing collateral — such as small items imprinted with your company’s name and logo — provided they’re widely distributed and cost less than $4 each.

The $25 limit is for gifts to individuals. There’s no set limit on gifts to a company (for example, a gift basket for all of a customer’s team members to share) as long as the cost is “reasonable.”

A holiday party

Under the Tax Cuts and Jobs Act, certain deductions for business-related meals were reduced and the deduction for business entertainment was eliminated. However, there’s an exception for certain recreational activities, including holiday parties.

Holiday parties are fully deductible (and excludible from recipients’ income) so long as they’re primarily for the benefit of employees who aren’t highly compensated and their families. If customers, and others also attend, a holiday party may be partially deductible.

Holiday cards

Sending holiday cards is a nice way to show customers and clients your appreciation. If you use the cards to promote your business, you can probably deduct the cost. Incorporate your company name and logo, and you might even want to include a discount coupon for your products or services.

Boost morale with festive gestures

If you have questions about giving holiday gifts to employees or customers or throwing a holiday party, contact us. We can explain the tax implications.

© 2023

4 ideas that may help reduce your 2023 tax bill

- Details

- Published: 07 December 2023 07 December 2023

If you’re concerned about your 2023 tax bill, there may still be time to reduce it. Here are four quick strategies that may help you trim your taxes before year end.

1. Accelerate deductions and/or defer income. Certain tax deductions are claimed for the year of payment, such as the mortgage interest deduction. So, if you make your January 2024 payment in December, you can deduct the interest portion on your 2023 tax return (assuming you itemize).

Pushing income into the new year also will reduce your taxable income. If you’re expecting a bonus at work, for example, and you don’t want the income this year, ask if your employer can hold off on paying it until January. If you’re self-employed, you can delay sending invoices until late in December to postpone the revenue to 2024.

You shouldn’t follow this approach if you expect to be in a higher tax bracket next year. Also, if you’re eligible for the qualified business income deduction for pass-through entities, you might reduce the amount of that deduction if you reduce your income.

2. Take full advantage of retirement contributions. Federal tax law encourages individual taxpayers to make the allowable contributions for the year to their retirement accounts, including traditional IRAs and SEP plans, 401(k)s and deferred annuities.

For 2023, you generally can contribute as much as $22,500 to 401(k)s and $6,500 to traditional IRAs. Self-employed individuals can contribute up to 25% of net income (but no more than $66,000) to a SEP IRA.

3. Harvest your investment losses. Losing money on your investments has a bit of an upside — it gives you the opportunity to offset taxable gains. If you sell underperforming investments before the end of the year, you can offset gains realized this year on a dollar-for-dollar basis.

If you have more losses than gains, you generally can apply up to $3,000 of the excess to reduce your ordinary income. Any remaining losses are carried forward to future tax years.

4. Donate to charity using investments. If you itemize deductions and want to donate to IRS-approved public charities, you can simply write a check or use a credit card. Or you can use your taxable investment portfolio of stock and/or mutual funds. Consider making charitable contributions according to these tax-smart principles:

- Underperforming stocks. Sell taxable investments that are worth less than they cost and book the resulting tax-saving capital loss. Then, give the sales proceeds to a charity and claim the resulting tax-saving charitable write-off. This strategy delivers a double tax benefit: You receive tax-saving capital losses plus a tax-saving itemized deduction for your charitable donations.

- Appreciated stocks. For taxable investments that are currently worth more than they cost, you can donate the stock directly to a charity. Contributions of publicly traded shares that you’ve owned for over a year result in a charitable deduction equal to the current market value of the shares at the time of the gift. Plus, when you donate appreciated investments, you escape any capital gains taxes on those shares. This strategy also provides a double tax benefit: You avoid capital gains tax and you get a tax-saving itemized deduction for charitable contributions.

Time is running out

The ideas described above are only a few of the strategies that still may be available. Contact us if you have questions about these or other methods for minimizing your tax liability for 2023.

© 2023

A company car is a valuable perk but don’t forget about taxes

- Details

- Published: 05 December 2023 05 December 2023

One of the most appreciated fringe benefits for owners and employees of small businesses is the use of a company car. This perk results in tax deductions for the employer as well as tax breaks for the owners and employees driving the cars. (And of course, they enjoy the nontax benefit of using a company car.) Even better, current federal tax rules make the benefit more valuable than it was in the past.

Rolling out the rules

Let’s take a look at how the rules work in a typical situation. For example, a corporation decides to supply the owner-employee with a company car. The owner-employee needs the car to visit customers and satellite offices, check on suppliers and meet with vendors. He or she expects to drive the car 8,500 miles a year for business and also anticipates using the car for about 7,000 miles of personal driving. This includes commuting, running errands and taking weekend trips. Therefore, the usage of the vehicle will be approximately 55% for business and 45% for personal purposes. Naturally, the owner-employee wants an attractive car that reflects positively on the business, so the corporation buys a new $57,000 luxury sedan.

The cost for personal use of the vehicle is equal to the tax the owner-employee pays on the fringe benefit value of the 45% personal mileage. In contrast, if the owner-employee bought the car to drive the personal miles, he or she would pay out-of-pocket for the entire purchase cost of the car.

Personal use is treated as fringe benefit income. For tax purposes, the corporation treats the car much the same way it would any other business asset, subject to depreciation deduction restrictions if the auto is purchased. Out-of-pocket expenses related to the car (including insurance, gas, oil and maintenance) are deductible, including the portion that relates to personal use. If the corporation finances the car, the interest it pays on the loan is deductible as a business expense (unless the business is subject to the business interest expense deduction limitation under the tax code).

On the other hand, if the owner-employee buys the auto, he or she isn’t entitled to any deductions. Outlays for the business-related portion of driving are unreimbursed employee business expenses, which are nondeductible from 2018 to 2025 due to the suspension of miscellaneous itemized deductions under the Tax Cuts and Jobs Act. And if the owner-employee finances the car personally, the interest payments are nondeductible.

One other implication: The purchase of the car by the corporation has no effect on the owner-employee’s credit rating.

Careful recordkeeping is essential

Supplying a vehicle for an owner’s or key employee’s business and personal use comes with complications and paperwork. Personal use needs to be tracked and valued under the fringe benefit tax rules and treated as income. This article only explains the basics.

Despite the necessary valuation and paperwork, a company-provided car is still a valuable fringe benefit for business owners and key employees. It can provide them with the use of a vehicle at a low tax cost while generating tax deductions for their businesses. (You may even be able to transfer the vehicle to the employee when you’re ready to dispose of it, but that involves other tax implications.) We can help you stay in compliance with the rules and explain more about this fringe benefit.

© 2023

Key 2024 inflation-adjusted tax parameters for small businesses and their owners

- Details

- Published: 21 November 2023 21 November 2023

The IRS recently announced various inflation-adjusted federal income tax amounts. Here’s a rundown of the amounts that are most likely to affect small businesses and their owners.

Rates and brackets

If you run your business as a sole proprietorship or pass-through business entity (LLC, partnership or S corporation), the business’s net ordinary income from operations is passed through to you and reported on your personal Form 1040. You then pay the individual federal income tax rates on that income.

Here are the 2024 inflation adjusted bracket thresholds.

- 10% tax bracket: $0 to $11,600 for singles, $0 to $23,200 for married joint filers, $0 to $16,550 for heads of household;

- Beginning of 12% bracket: $11,601 for singles, $23,201 for married joint filers, $16,551 for heads of household;

- Beginning of 22% bracket: $47,151 for singles, $94,301 for married joint filers, $63,101 for heads of household;

- Beginning of 24% bracket: $100,526 for singles, $201,051 for married joint filers, $100,501 for heads of household;

- Beginning of 32% bracket: $191,951 for singles, $383,901 for married joint filers, $191,951 for heads of household;

- Beginning of 35% bracket: $243,726 for singles, $487,451 for married joint filers and $243,701 for heads of household; and

- Beginning of 37% bracket: $609,351 for singles, $731,201 for married joint filers and $609,351 for heads of household.

Key Point: These thresholds are about 5.4% higher than for 2023. That means that, other things being equal, you can have about 5.4% more ordinary business income next year without owing more to Uncle Sam.

Section 1231 gains and qualified dividends

If you run your business as a sole proprietorship or a pass-through entity, and the business sells assets, you may have Section 1231 gains that passed through to you to be included on your personal Form 1040. Sec. 1231 gains are long-term gains from selling business assets that were held for more than one year, and they’re generally taxed at the same lower federal rates that apply to garden-variety long-term capital gains (LTCGs), such as stock sale gains. Here are the 2024 inflation-adjusted bracket thresholds that will generally apply to Sec. 1231 gains recognized by individual taxpayers.

- 0% tax bracket: $0 to $47,025 for singles, $0 to $94,050 for married joint filers and $0 to $63,000 for heads of household;

- Beginning of 15% bracket: $47,026 for singles, $94,051 for joint filers, $63,001 for heads of household; and

- Beginning of 20% bracket: $518,901 for singles, $583,751 for married joint filers and $551,351 for heads of household.

If you run your business as a C corporation, and the company pays you qualified dividends, they’re taxed at the lower LTCG rates. So, the 2024 rate brackets for qualified dividends paid to individual taxpayers will be the same as above.

Self-employment tax

If you operate your business as a sole proprietorship or as a pass-through entity, you probably have net self-employment (SE) income that must be reported on your personal Form 1040 to calculate your SE tax liability. For 2024, the maximum 15.3% SE tax rate will apply to the first $166,800 of net SE income (up from $160,200 for 2023).

Section 179 deductions

For tax years beginning in 2024, small businesses can potentially write off up to $1,220,000 of qualified asset additions in year one (up from $1,160,000 for 2023). However, the maximum deduction amount begins to be phased out once qualified asset additions exceed $3,050,000 (up from $2,890,000 for 2023). Various limitations apply to Sec. 179 deductions.

Side Note: Under the first-year bonus depreciation break, you can deduct up to 60% of the cost of qualified asset additions placed in service in calendar year 2024. For 2023, you could deduct up to 80%.

Just the beginning

These are only the 2024 inflation-adjusted amounts that are most likely to affect small businesses and their owners. There are others that may potentially apply, including: limits on qualified business income deductions and business loss deductions, income limits on various favorable exceptions such as the right to use cash-method accounting, limits on how much you can contribute to your self-employed or company-sponsored tax-favored retirement account, limits on tax-free transportation allowances for employees, and limits on tax-free adoption assistance for employees. Contact us with questions about your situation.

© 2023

11 Exceptions to the 10% penalty tax on early IRA withdrawals

- Details

- Published: 15 November 2023 15 November 2023

If you’re facing a serious cash shortfall, one possible solution is to take an early withdrawal from your traditional IRA. That means one before you’ve reached age 59½. For this purpose, traditional IRAs include simplified employee pension (SEP-IRA) and SIMPLE-IRA accounts.

Here’s what you need to know about the tax implications, including when the 10% early withdrawal penalty tax might apply.

Penalty may be avoided

In almost all cases, all or part of a withdrawal from a traditional IRA will constitute taxable income. The taxable percentage depends on whether you’ve made any nondeductible contributions to your traditional IRAs. If you have, each withdrawal from a traditional IRA consists of a proportionate amount of your total nondeductible contributions. That part is tax-free. The proportionate amount of each withdrawal that consists of deductible contributions and accumulated earnings is taxable. If you’ve never made any nondeductible contributions, 100% of a withdrawal is taxable.

Wide variety of exceptions

Unless one of these 11 exceptions applies, there will be a 10% early withdrawal penalty tax on the taxable portion of a traditional IRA withdrawal taken before age 59½.

1. Substantially equal periodic payments (SEPPs). These are annual annuity-like withdrawals that must be taken for at least five years or until the you reach age 59½, whichever comes later. Because the SEPP rules are complicated, consult with us to avoid pitfalls.

2. Withdrawals for medical expenses. If you have qualified medical expenses in excess of 7.5% of your adjusted gross income, the excess is exempt from the penalty tax.

3. Higher education expense withdrawals. Early withdrawals are penalty-free to the extent of qualified higher education expenses paid during the same year.

4. Withdrawals for health insurance premiums while unemployed. This exception is available to an IRA owner who has received unemployment compensation payments for 12 consecutive weeks under any federal or state unemployment compensation law during the year in question or the preceding year.

5. Birth or adoption withdrawals. Penalty-free treatment is available for qualified birth or adoption withdrawals of up to $5,000 for each eligible event.

6. Withdrawals for first-time home purchases. Penalty-free withdrawals are allowed to an account owner within 120 days to pay qualified principal residence acquisition costs, subject to a $10,000 lifetime limit.

7. Withdrawals by certain military reservists. Early withdrawals taken by military reserve members called to active duty for at least 180 days or for an indefinite period are exempt from the 10% penalty.

8. Withdrawals after disability. Early withdrawals taken by an IRA owner who is physically or mentally disabled to the extent that the owner cannot engage in his or her customary gainful activity or a comparable gainful activity are exempt from the penalty tax. The disability must be expected to lead to death or be of long or indefinite duration.

9. Withdrawals to satisfy certain IRS debts. This applies to early IRA withdrawals taken to pay IRS levies against the account.

10. Withdrawals after death. Withdrawals taken from an IRA after the account owner’s death are always exempt from the 10% penalty. However, this exemption isn’t available for funds rolled over into the surviving spouse’s IRA or if the surviving spouse elects to treat an IRA inherited from the deceased spouse as the spouse’s own account.

11. Penalty-free withdrawals for emergencies coming soon. The SECURE 2.0 law adds a new exception for certain distributions used for emergency expenses, which are defined as unforeseeable or immediate financial needs relating to personal or family emergencies. Only one distribution of up to $1,000 is permitted a year and a taxpayer has the option to repay it within three years. This provision is effective for distributions made after December 31, 2023.

Plan ahead

Since most or all of an early traditional IRA withdrawal will probably be taxable, it could push you into a higher marginal federal income tax bracket. You may also owe the 10% early withdrawal penalty and possibly state income tax too. Note that the penalty tax exceptions generally have additional requirements that we haven’t covered here. Contact us for more details.

© 2023

A cost segregation study may cut taxes and boost cash flow

- Details

- Published: 14 November 2023 14 November 2023

Is your business depreciating over 30 years the entire cost of constructing the building that houses your enterprise? If so, you should consider a cost segregation study. It may allow you to accelerate depreciation deductions on certain items, thereby reducing taxes and boosting cash flow.

Depreciation basics

Business buildings generally have a 39-year depreciation period (27.5 years for residential rental properties). In most cases, a business depreciates a building’s structural components, including walls, windows, HVAC systems, elevators, plumbing and wiring, along with the building. Personal property — including equipment, machinery, furniture and fixtures — is eligible for accelerated depreciation, usually over five or seven years. And land improvements, such as fences, outdoor lighting and parking lots, are depreciable over 15 years.

Frequently, businesses allocate all or most of their buildings’ acquisition or construction costs to real property, overlooking opportunities to allocate costs to shorter-lived personal property or land improvements. In some cases, the distinction between real and personal property is obvious. For example, computers and furniture are personal property. But the line between real and personal property is not always clear. Items that appear to be “part of a building” may in fact be personal property. Examples are removable wall and floor coverings, removable partitions, awnings and canopies, window treatments, decorative lighting and signs.

In addition, certain items that otherwise would be treated as real property may qualify as personal property if they serve more of a business function than a structural purpose. These include reinforced flooring that supports heavy manufacturing equipment, electrical or plumbing installations required to operate specialized equipment and dedicated cooling systems for data processing rooms.

Identifying and substantiating costs

A cost segregation study combines accounting and engineering techniques to identify building costs that are properly allocable to tangible personal property rather than real property. Although the relative costs and benefits of a cost segregation study depend on your particular facts and circumstances, it can be a valuable investment.

Speedier depreciation tax breaks

The Tax Cuts and Jobs Act (TCJA) enhanced certain depreciation-related tax breaks, which may also enhance the benefits of a cost segregation study. Among other changes, the law permanently increased limits on Section 179 expensing, which allows you to immediately deduct the entire cost of qualifying equipment or other fixed assets up to specified thresholds.

In addition, the TCJA expanded 15-year-property treatment to apply to qualified improvement property. Previously, this tax break was limited to qualified leasehold-improvement, retail-improvement and restaurant property. And the law temporarily increased first-year bonus depreciation from 50% to 100% in 2022, 80% in 2023 and 60% in 2024. After that, it will continue to decrease until it is 0% in 2027, unless Congress acts.

Making favorable depreciation changes

It isn’t too late to get the benefit of faster depreciation for items that were incorrectly assumed to be part of your building for depreciation purposes. You don’t have to amend your past returns (or meet a deadline for claiming tax refunds) to claim the depreciation that you could have already claimed. Instead, you can claim that depreciation by following procedures, in connection with the next tax return you file, that will result in automatic IRS consent to a change in your accounting for depreciation.

Cost segregation studies can yield substantial benefits, but they’re not the best move for every business. Contact us to determine whether this strategy would work for your business. We’ll judge whether a study will result in tax savings that are greater than the costs of the study itself.

© 2023