Weekly Tax Brief

Fully deduct business meals this year

- Details

- Published: 05 April 2022 05 April 2022

The federal government is helping to pick up the tab for certain business meals. Under a provision that’s part of one of the COVID-19 relief laws, the usual deduction for 50% of the cost of business meals is doubled to 100% for food and beverages provided by restaurants in 2022 (and 2021).

So, you can take a customer out for a business meal or order take-out for your team and temporarily write off the entire cost — including the tip, sales tax and any delivery charges.

Basic rules

Despite eliminating deductions for business entertainment expenses in the Tax Cuts and Jobs Act (TCJA), a business taxpayer could still deduct 50% of the cost of qualified business meals, including meals incurred while traveling away from home on business. (The TCJA generally eliminated the 50% deduction for business entertainment expenses incurred after 2017 on a permanent basis.)

To help struggling restaurants during the pandemic, the Consolidated Appropriations Act doubled the business meal deduction temporarily for 2021 and 2022. Unless Congress acts to extend this tax break, it will expire on December 31, 2022.

Currently, the deduction for business meals is allowed if the following requirements are met:

- The expense is an ordinary and necessary business expense paid or incurred during the tax year in carrying on any trade or business.

- The expense isn’t lavish or extravagant under the circumstances.

- The taxpayer (or an employee of the taxpayer) is present when the food or beverages are furnished.

- The food and beverages are provided to a current or potential business customer, client, consultant or similar business contact.

In the event that food and beverages are provided during an entertainment activity, the food and beverages must be purchased separately from the entertainment. Alternatively, the cost can be stated separately from the cost of the entertainment on one or more bills.

So, if you treat a client to a meal and the expense is properly substantiated, you may qualify for a business meal deduction as long as there’s a business purpose to the meal or a reasonable expectation that a benefit to the business will result.

Provided by a restaurant

IRS Notice 2021-25 explains the main rules for qualifying for the 100% deduction for food and beverages provided by a restaurant. Under this guidance, the deduction is available if the restaurant prepares and sells food or beverages to retail customers for immediate consumption on or off the premises. As a result, it applies to both on-site dining and take-out and delivery meals.

However, a “restaurant” doesn’t include a business that mainly sells pre-packaged goods not intended for immediate consumption. So, food and beverage sales are excluded from businesses including:

- Grocery stores,

- Convenience stores,

- Beer, wine or liquor stores, and

- Vending machines or kiosks.

The restriction also applies to an eating facility located on the employer’s business premises that provides meals excluded from an employee’s taxable income. Business meals purchased from such facilities are limited to a 50% deduction. It doesn’t matter if a third party is operating the facility under a contract with the business.

Keep good records

It’s important to keep track of expenses to maximize tax benefits for business meal expenses.

You should record the:

- Date,

- Cost of each expense,

- Name and location of the establishment,

- Business purpose, and

- Business relationship of the person(s) fed.

In addition, ask establishments to divvy up the tab between any entertainment costs and food/ beverages. For additional information, contact your tax advisor.

© 2022

It’s almost that time of year again! If you’re not ready, file for an extension

- Details

- Published: 01 April 2022 01 April 2022

The clock is ticking down to the April 18 tax filing deadline. Sometimes, it’s not possible to gather your tax information and file by the due date. If you need more time, you should file for an extension on Form 4868.

An extension will give you until October 17 to file and allows you to avoid incurring “failure-to-file” penalties. However, it only provides extra time to file, not to pay. Whatever tax you estimate is owed must still be sent by April 18, or you’ll incur penalties — and as you’ll see below, they can be steep.

Failure to file vs. failure to pay

Separate penalties apply for failing to pay and failing to file. The failure-to-pay penalty runs at 0.5% for each month (or part of a month) the payment is late. For example, if payment is due April 18 and is made May 25, the penalty is 1% (0.5% times 2 months or partial months). The maximum penalty is 25%.

The failure-to-pay penalty is based on the amount shown as due on the return (less credits for amounts paid via withholding or estimated payments), even if the actual tax bill turns out to be higher. On the other hand, if the actual tax bill turns out to be lower, the penalty is based on the lower amount.

The failure-to-file penalty runs at the more severe rate of 5% per month (or partial month) of lateness to a maximum 25%. If you file for an extension on Form 4868, you’re not filing late unless you miss the extended due date. However, as mentioned earlier, a filing extension doesn’t apply to your responsibility for payment.

If the 0.5% failure-to-pay penalty and the failure-to-file penalty both apply, the failure-to-file penalty drops to 4.5% per month (or part) so the combined penalty is 5%. The maximum combined penalty for the first five months is 25%. Thereafter, the failure-to-pay penalty can continue at 0.5% per month for 45 more months (an additional 22.5%). Thus, the combined penalties can reach a total of 47.5% over time.

The failure-to-file penalty is also more severe because it’s based on the amount required to be shown on the return, and not just the amount shown as due. (Credit is given for amounts paid via withholding or estimated payments. If no amount is owed, there’s no penalty for late filing.) For example, if a return is filed three months late showing $5,000 owed (after payment credits), the combined penalties would be 15%, which equals $750. If the actual liability is later determined to be an additional $1,000, the failure-to-file penalty (4.5% × 3 = 13.5%) would also apply to this amount for an additional $135 in penalties.

A minimum failure-to-file penalty also applies if a return is filed more than 60 days late. This minimum penalty is the lesser of $435 (for returns due through 2022) or the amount of tax required to be shown on the return.

Reasonable cause

Both penalties may be excused by the IRS if lateness is due to “reasonable cause” such as death or serious illness in the immediate family.

Interest is assessed at a fluctuating rate announced by the government apart from and in addition to the above penalties. Furthermore, in particularly abusive situations involving a fraudulent failure to file, the late filing penalty can jump to 15% per month, with a 75% maximum.

Contact us if you have questions about IRS penalties or about filing Form 4868.

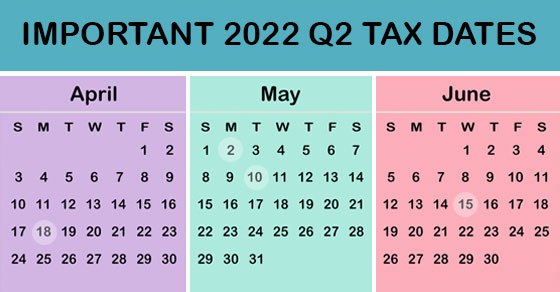

2022 Q2 tax calendar: Key deadlines for businesses and other employers

- Details

- Published: 29 March 2022 29 March 2022

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

April 18

- If you’re a calendar-year corporation, file a 2021 income tax return (Form 1120) or file for an automatic six-month extension (Form 7004) and pay any tax due.

- Corporations pay the first installment of 2022 estimated income taxes.

- For individuals, file a 2021 income tax return (Form 1040 or Form 1040-SR) or file for an automatic six-month extension (Form 4868) and paying any tax due. (See June 15 for an exception for certain taxpayers.)

- For individuals, pay the first installment of 2022 estimated taxes, if you don’t pay income tax through withholding (Form 1040-ES).

May 2

- Employers report income tax withholding and FICA taxes for the first quarter of 2022 (Form 941) and pay any tax due.

May 10

- Employers report income tax withholding and FICA taxes for the first quarter of 2022 (Form 941), if you deposited on time and fully paid all of the associated taxes due.

June 15

- Corporations pay the second installment of 2022 estimated income taxes.

© 2022

The tax rules of renting out a vacation property

- Details

- Published: 25 March 2022 25 March 2022

Summer is just around the corner. If you’re fortunate enough to own a vacation home, you may wonder about the tax consequences of renting it out for part of the year.

The tax treatment depends on how many days it’s rented and your level of personal use. Personal use includes vacation use by your relatives (even if you charge them market rate rent) and use by nonrelatives if a market rate rent isn’t charged.

If you rent the property out for less than 15 days during the year, it’s not treated as “rental property” at all. In the right circumstances, this can produce significant tax benefits. Any rent you receive isn’t included in your income for tax purposes (no matter how substantial). On the other hand, you can only deduct property taxes and mortgage interest — no other operating costs and no depreciation. (Mortgage interest is deductible on your principal residence and one other home, subject to certain limits.)

If you rent the property out for more than 14 days, you must include the rent you receive in income. However, you can deduct part of your operating expenses and depreciation, subject to several rules. First, you must allocate your expenses between the personal use days and the rental days. For example, if the house is rented for 90 days and used personally for 30 days, then 75% of the use is rental (90 days out of 120 total days). You would allocate 75% of your maintenance, utilities, insurance, etc., costs to rental. You would allocate 75% of your depreciation allowance, interest, and taxes for the property to rental as well. The personal use portion of taxes is separately deductible. The personal use portion of interest on a second home is also deductible if the personal use exceeds the greater of 14 days or 10% of the rental days. However, depreciation on the personal use portion isn’t allowed.

If the rental income exceeds these allocable deductions, you report the rent and deductions to determine the amount of rental income to add to your other income. If the expenses exceed the income, you may be able to claim a rental loss. This depends on how many days you use the house personally.

Here’s the test: if you use it personally for more than the greater of 1) 14 days, or 2) 10% of the rental days, you’re using it “too much,” and you can’t claim your loss. In this case, you can still use your deductions to wipe out rental income, but you can’t go beyond that to create a loss. Any unused deductions are carried forward and may be usable in future years. If you’re limited to using deductions only up to the amount of rental income, you must use the deductions allocated to the rental portion in the following order: 1) interest and taxes, 2) operating costs, 3) depreciation.

If you “pass” the personal use test (i.e., you don’t use the property personally more than the greater of the figures listed above), you must still allocate your expenses between the personal and rental portions. In this case, however, if your rental deductions exceed rental income, you can claim the loss. (The loss is “passive,” however, and may be limited under the passive loss rules.)

As you can see, the rules are complex. Contact us if you have questions or would like to plan ahead to maximize deductions in your situation.

© 2022

Taking the opposite approach: Ways your business can accelerate taxable income and defer deductions

- Details

- Published: 22 March 2022 22 March 2022

Typically, businesses want to delay recognition of taxable income into future years and accelerate deductions into the current year. But when is it prudent to do the opposite? And why would you want to?

One reason might be tax law changes that raise tax rates. There have been discussions in Washington about raising the corporate federal income tax rate from its current flat 21%. Another reason may be because you expect your noncorporate pass-through entity business to pay taxes at higher rates in the future, because the pass-through income will be taxed on your personal return. There have also been discussions in Washington about raising individual federal income tax rates.

If you believe your business income could be subject to tax rate increases, you might want to accelerate income recognition into the current tax year to benefit from the current lower tax rates. At the same time, you may want to postpone deductions into a later tax year, when rates are higher, and when the deductions will do more tax-saving good.

To accelerate income

Consider these options if you want to accelerate revenue recognition into the current tax year:

- Sell appreciated assets that have capital gains in the current year, rather than waiting until a later year.

- Review the company’s list of depreciable assets to determine if any fully depreciated assets are in need of replacement. If fully depreciated assets are sold, taxable gains will be triggered in the year of sale.

- For installment sales of appreciated assets, elect out of installment sale treatment to recognize gain in the year of sale.

- Instead of using a tax-deferred like-kind Section 1031 exchange, sell real property in a taxable transaction.

- Consider converting your S corporation into a partnership or LLC treated as a partnership for tax purposes. That will trigger gains from the company’s appreciated assets because the conversion is treated as a taxable liquidation of the S corp. The partnership will have an increased tax basis in the assets.

- For a construction company, do you have long-term construction contracts previously exempt from the percentage-of-completion method of accounting for long-term contracts? Consider using the percentage-of-completion method to recognize income sooner as compared to the completed contract method, which defers recognition of income until the long-term construction is completed.

To defer deductions

Consider the following actions to postpone deductions into a higher-rate tax year, which will maximize their value:

- Delay purchasing capital equipment and fixed assets, which would give rise to depreciation deductions.

- Forego claiming big first-year Section 179 deductions or bonus depreciation deductions on new depreciable assets and instead depreciate the assets over a number of years.

- Determine whether professional fees and employee salaries associated with a long-term project could be capitalized, which would spread out the costs over time and push the related deductions forward into a higher rate tax year.

- Purchase bonds at a discount this year to increase interest income in future years.

- If allowed, put off inventory shrinkage or other write-downs until a year with a higher tax rate.

- Delay charitable contributions into a year with a higher tax rate.

- If allowed, delay accounts receivable charge-offs to a year with a higher rate.

- Delay payment of liabilities where the related deduction is based on when the amount is paid.

Contact us to discuss the best tax planning actions in light of your business’s unique tax situation.

© 2022

When inheriting money, be aware of “income in respect of a decedent” issues

- Details

- Published: 17 March 2022 17 March 2022

Once a relatively obscure concept, “income in respect of a decedent” (IRD) may create a surprising tax bill for those who inherit certain types of property, such as IRAs or other retirement plans. Fortunately, there may be ways to minimize or even eliminate the IRD tax bite.

Basic rules

For the most part, property you inherit isn’t included in your income for tax purposes. Items that are IRD, however, do have to be included in your income, although you may also be entitled to an IRD deduction on account of them.

What’s IRD? It is income that the decedent (the person from whom you inherit the property) would have taken into income on his or her final income tax return except that death interceded. One common IRD item is the decedent’s last paycheck, received after death. It would have normally been included in the decedent’s income on the final income tax return. However, since the decedent’s tax year closed as of the date of death, it wasn’t included. As an item of IRD, it’s taxed as income to whomever does receive it (the estate or another individual). Not just the final paycheck, but any compensation-related benefits paid after death, such as accrued vacation pay or voluntary employer benefit payments, will be IRD to the recipient.

Other common IRD items include pension benefits and amounts in a decedent’s individual retirement accounts (IRAs) at death as well as a decedent’s share of partnership income up to the date of death. If you receive these IRD items, they’re included in your income.

The IRD deduction

Although IRD must be included in the income of the recipient, a deduction may come along with it. The deduction is allowed (as an itemized deduction) to lessen the “double tax” impact that’s caused by having the IRD items subject to the decedent’s estate tax as well as the recipient’s income tax.

To calculate the IRD deduction, the decedent’s executor may have to be contacted for information. The deduction is determined as follows:

- First, you must take the “net value” of all IRD items included in the decedent’s estate. The net value is the total value of the IRD items in the estate, reduced by any deductions in respect of the decedent. These are items which are the converse of IRD: items the decedent would have deducted on the final income tax return, but for death’s intervening.

- Next you determine how much of the federal estate tax was due to this net IRD by calculating what the estate tax bill would have been without it. Your deduction is then the percentage of the tax that your portion of the IRD items represents.

In the following example, the top estate tax rate of 40% is used. Example: At Tom’s death, $50,000 of IRD items were included in his gross estate, $10,000 of which were paid to Alex. There were also $3,000 of deductions in respect of a decedent, for a net value of $47,000. Had the estate been $47,000 less, the estate tax bill would have been $18,800 less. Alex will include in income the $10,000 of IRD received. If Alex itemizes deductions, Alex may also deduct $3,760, which is 20% (10,000/50,000) of $18,800.

We can help

If you inherit property that could be considered IRD, consult with us for assistance in managing the tax consequences.

© 2022

Establish a tax-favored retirement plan

- Details

- Published: 15 March 2022 15 March 2022

If your business doesn’t already have a retirement plan, now might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions.

For example, if you’re self-employed and set up a SEP-IRA, you can contribute up to 20% of your self-employment earnings, with a maximum contribution of $61,000 for 2022. If you’re employed by your own corporation, up to 25% of your salary can be contributed to your account, with a maximum contribution of $61,000. If you’re in the 32% federal income tax bracket, making a maximum contribution could cut what you owe Uncle Sam for 2022 by a whopping $19,520 (32% times $61,000).

More options

Other small business retirement plan options include:

- 401(k) plans, which can even be set up for just one person (also called solo 401(k)s),

- Defined benefit pension plans, and

- SIMPLE-IRAs.

Depending on your circumstances, these other types of plans may allow bigger deductible contributions.

Deadlines to establish and contribute

Thanks to a change made by the 2019 SECURE Act, tax-favored qualified employee retirement plans, except for SIMPLE-IRA plans, can now be adopted by the due date (including any extension) of the employer’s federal income tax return for the adoption year. The plan can then receive deductible employer contributions that are made by the due date (including any extension), and the employer can deduct those contributions on the return for the adoption year.

Important: The SECURE Act provision didn’t change the deadline to establish a SIMPLE-IRA plan. It remains October 1 of the year for which the plan is to take effect. Also, the SECURE Act change doesn’t override rules that require certain plan provisions to be in effect during the plan year, such as the provisions that cover employee elective deferral contributions (salary-reduction contributions) under a 401(k) plan. The plan must be in existence before such employee elective deferral contributions can be made.

For example, the deadline for the 2021 tax year for setting up a SEP-IRA for a sole proprietorship business that uses the calendar year for tax purposes is October 17, 2022, if you extend your 2021 tax return. The deadline for making the contribution for the 2021 tax year is also October 17, 2022. However, to make a SIMPLE-IRA contribution for the 2021 tax year, you must have set up the plan by October 1, 2021. So, it’s too late to set up a plan for last year.

While you can delay until next year establishing a tax-favored retirement plan for this year (except for a SIMPLE-IRA plan), why wait? Get it done this year as part of your tax planning and start saving for retirement. We can provide more information on small business retirement plan alternatives. Be aware that, if your business has employees, you may have to make contributions for them, too.

© 2022

Lost your job? Here are the tax aspects of an employee termination

- Details

- Published: 10 March 2022 10 March 2022

Despite the robust job market, there are still some people losing their jobs. If you’re laid off or terminated from employment, taxes are probably the last thing on your mind. However, there are tax implications due to your changed personal and professional circumstances. Depending on your situation, the tax aspects can be complex and require you to make decisions that may affect your tax picture this year and for years to come.

Unemployment and severance pay

Unemployment compensation is taxable, as are payments for any accumulated vacation or sick time. Although severance pay is also taxable and subject to federal income tax withholding, some elements of a severance package may be specially treated. For example:

- If you sell stock acquired by way of an incentive stock option (ISO), part or all of your gain may be taxed at lower long-term capital gain rates rather than at ordinary income tax rates, depending on whether you meet a special dual holding period.

- If you received — or will receive — what’s commonly referred to as a “golden parachute payment,” you may be subject to an excise tax equal to 20% of the portion of the payment that’s treated as an “excess parachute payment” under very complex rules, along with the excess parachute payment also being subject to ordinary income tax.

- The value of job placement assistance you receive from your former employer usually is tax-free. However, the assistance is taxable if you had a choice between receiving cash or outplacement help.

Health insurance

Also, be aware that under the COBRA rules, most employers that offer group health coverage must provide continuation coverage to most terminated employees and their families. While the cost of COBRA coverage may be expensive, the cost of any premium you pay for insurance that covers medical care is a medical expense, which is deductible if you itemize deductions and if your total medical expenses exceed 7.5% of your adjusted gross income.

If your ex-employer pays for some of your medical coverage for a period of time following termination, you won’t be taxed on the value of this benefit. And if you lost your job as a result of a foreign-trade-related circumstance, you may qualify for a refundable credit for 72.5% of your qualifying health insurance costs.

Retirement plans

Employees whose employment is terminated may also need tax planning help to determine the best option for amounts they’ve accumulated in retirement plans sponsored by former employers. For most, a tax-free rollover to an IRA is the best move, if the terms of the plan allow a pre-retirement payout.

If the distribution from the retirement plan includes employer securities in a lump sum, the distribution is taxed under the lump-sum rules except that “net unrealized appreciation” in the value of the stock isn’t taxed until the securities are sold or otherwise disposed of in a later transaction. If you’re under age 59½, and must make withdrawals from your company plan or IRA to supplement your income, there may be an additional 10% penalty tax to pay unless you qualify for an exception.

Further, any loans you’ve taken out from your employer’s retirement plan, such as a 401(k)-plan loan, may be required to be repaid immediately, or within a specified period. If they aren’t, they may be treated as if the loan is in default. If the balance of the loan isn’t repaid within the required period, it will typically be treated as a taxable deemed distribution.

Contact us so that we can chart the best tax course for you during this transition period.

© 2022

There still may be time to cut your tax bill with an IRA

- Details

- Published: 03 March 2022 03 March 2022

If you’re getting ready to file your 2021 tax return, and your tax bill is more than you’d like, there might still be a way to lower it. If you’re eligible, you can make a deductible contribution to a traditional IRA right up until the April 18, 2022, filing date and benefit from the tax savings on your 2021 return.

Do you qualify?

You can make a deductible contribution to a traditional IRA if:

- You (and your spouse) aren’t an active participant in an employer-sponsored retirement plan, or

- You (or your spouse) are an active participant in an employer plan, but your modified adjusted gross income (AGI) doesn’t exceed certain levels that vary from year-to-year by filing status.

For 2021, if you’re a joint tax return filer and you are covered by an employer plan, your deductible IRA contribution phases out over $105,000 to $125,000 of modified AGI. If you’re single or a head of household, the phaseout range is $66,000 to $76,000 for 2021. For married filing separately, the phaseout range is $0 to $10,000. For 2021, if you’re not an active participant in an employer-sponsored retirement plan, but your spouse is, your deductible IRA contribution phases out with modified AGI of between $198,000 and $208,000.

Deductible IRA contributions reduce your current tax bill, and earnings within the IRA are tax deferred. However, every dollar you take out is taxed in full (and subject to a 10% penalty before age 59½, unless one of several exceptions apply).

IRAs often are referred to as “traditional IRAs” to differentiate them from Roth IRAs. You also have until April 18 to make a Roth IRA contribution. But while contributions to a traditional IRA are deductible, contributions to a Roth IRA aren’t. However, withdrawals from a Roth IRA are tax-free as long as the account has been open at least five years and you’re age 59½ or older. (There are also income limits to contribute to a Roth IRA.)

Another IRA strategy that may help you save tax is to make a deductible IRA contribution, even if you don’t work. In general, you can’t make a deductible traditional IRA contribution unless you have wages or other earned income. However, an exception applies if your spouse is the breadwinner and you’re a homemaker. In this case, you may be able to take advantage of a spousal IRA.

How much can you contribute?

For 2021, if you’re eligible, you can make a deductible traditional IRA contribution of up to $6,000 ($7,000 if you’re 50 or over).

In addition, small business owners can set up and contribute to a Simplified Employee Pension (SEP) plan up until the due date for their returns, including extensions. For 2021, the maximum contribution you can make to a SEP is $58,000.

Contact us if you want more information about IRAs or SEPs. Or ask about them when we’re preparing your return. We can help you save the maximum tax-advantaged amount for retirement.

© 2022

The election to apply the research tax credit against payroll taxes

- Details

- Published: 01 March 2022 01 March 2022

The credit for increasing research activities, often referred to as the research and development (R&D) credit, is a valuable tax break available to eligible businesses. Claiming the credit involves complex calculations, which we can take care of for you. But in addition to the credit itself, be aware that the credit also has two features that are especially favorable to small businesses:

- Eligible small businesses ($50 million or less in gross receipts) may claim the credit against alternative minimum tax (AMT) liability.

- The credit can be used by certain even smaller startup businesses against the employer’s Social Security payroll tax liability.

Let’s take a look at the second feature. Subject to limits, you can elect to apply all or some of any research tax credit that you earn against your payroll taxes instead of your income tax. This payroll tax election may influence you to undertake or increase your research activities. On the other hand, if you’re engaged in — or are planning to undertake — research activities without regard to tax consequences, be aware that you could receive some tax relief.

Why the election is important

Many new businesses, even if they have some cash flow, or even net positive cash flow and/or a book profit, pay no income taxes and won’t for some time. Thus, there’s no amount against which business credits, including the research credit, can be applied. On the other hand, any wage-paying business, even a new one, has payroll tax liabilities. Therefore, the payroll tax election is an opportunity to get immediate use out of the research credits that you earn. Because every dollar of credit-eligible expenditure can result in as much as a 10-cent tax credit, that’s a big help in the start-up phase of a business — the time when help is most needed.

Eligible businesses

To qualify for the election a taxpayer must:

- Have gross receipts for the election year of less than $5 million and

- Be no more than five years past the period for which it had no receipts (the start-up period).

In making these determinations, the only gross receipts that an individual taxpayer takes into account are from the individual’s businesses. An individual’s salary, investment income or other income aren’t taken into account. Also, note that an entity or individual can’t make the election for more than six years in a row.

Limits on the election

The research credit for which the taxpayer makes the payroll tax election can be applied only against the Social Security portion of FICA taxes. It can’t be used to lower the employer’s lability for the “Medicare” portion of FICA taxes or any FICA taxes that the employer withholds and remits to the government on behalf of employees.

The amount of research credit for which the election can be made can’t annually exceed $250,000. Note, too, that an individual or C corporation can make the election only for those research credits which, in the absence of an election, would have to be carried forward. In other words, a C corporation can’t make the election for the research credit that the taxpayer can use to reduce current or past income tax liabilities.

The above are just the basics of the payroll tax election. Keep in mind that identifying and substantiating expenses eligible for the research credit itself is a complex area. Contact us about whether you can benefit from the payroll tax election and the research tax credit.

© 2022