Weekly Tax Brief

The kiddie tax: Does it affect your family?

- Details

- Published: 21 July 2022 21 July 2022

Many people wonder how they can save taxes by transferring assets into their children’s names. This tax strategy is called income shifting. It seeks to take income out of your higher tax bracket and place it in the lower tax brackets of your children.

While some tax savings are available through this approach, the “kiddie tax” rules impose substantial limitations if:

- The child hasn’t reached age 18 before the close of the tax year, or

- The child’s earned income doesn’t exceed half of his or her support and the child is age 18 or is a full-time student age 19 to 23.

The kiddie tax rules apply to your children who are under the cutoff age(s) described above, and who have more than a certain amount of unearned (investment) income for the tax year — $2,300 for 2022. While some tax savings on up to this amount can still be achieved by shifting income to children under the cutoff age, the savings aren’t substantial.

If the kiddie tax rules apply to your children and they have over the prescribed amount of unearned income for the tax year ($2,300 for 2022), they’ll be taxed on that excess amount at your (the parents’) tax rates if your rates are higher than the children’s tax rates. This kiddie tax is calculated by computing the “allocable parental tax” and special allocation rules apply if the parents have more than one child subject to the kiddie tax.

Note: Different rules applied for the 2018 and 2019 tax years, when the kiddie tax was computed based on the estates’ and trusts’ ordinary and capital gain rates, instead of the parents’ tax rates.

Be aware that, to transfer income to a child, you must transfer ownership of the asset producing the income. You can’t merely transfer the income itself. Property can be transferred to minor children using custodial accounts under state law.

Possible saving vehicles

The portion of investment income of a child that’s taxed under the kiddie tax rules may be reduced or eliminated if the child invests in vehicles that produce little or no current taxable income. These include:

- Securities and mutual funds oriented toward capital growth;

- Vacant land expected to appreciate in value;

- Stock in a closely held family business, expected to become more valuable as the business expands, but pays little or no cash dividends;

- Tax-exempt municipal bonds and bond funds;

- U.S. Series EE bonds, for which recognition of income can be deferred until the bonds mature, the bonds are cashed in or an election to recognize income annually is made.

Investments that produce no taxable income — and which therefore aren’t subject to the kiddie tax — also include tax-advantaged savings vehicles such as:

- Traditional and Roth IRAs, which can be established or contributed to if the child has earned income;

- Qualified tuition programs (also known as “529 plans”); and

- Coverdell education savings accounts.

A child’s earned income (as opposed to investment income) is taxed at the child’s regular tax rates, regardless of the amount. Therefore, to save taxes within the family, consider employing the child at your own business and paying reasonable compensation.

If the kiddie tax applies, it’s computed and reported on Form 8615, which is attached to the child’s tax return.

Two reporting options

Parents can elect to include the child’s income on their own return if certain requirements are satisfied. This is done on Form 8814 and avoids the need for a separate return for the child. Contact us if you have questions about the kiddie tax.

© 2022

Important considerations when engaging in a like-kind exchange

- Details

- Published: 19 July 2022 19 July 2022

A business or individual might be able to dispose of appreciated real property without being taxed on the gain by exchanging it rather than selling it. You can defer tax on your gain through a “like-kind” or Section 1031 exchange.

A like-kind exchange is a swap of real property held for investment or for productive use in your trade or business for like-kind investment real property or business real property. For these purposes, “like-kind” is very broadly defined, and most real property is considered to be like-kind with other real property. However, neither the relinquished property nor the replacement property can be real property held primarily for sale. If you’re unsure whether the property involved in your exchange is eligible for a like-kind exchange, contact us to discuss the matter.

Here’s how the tax rules work

If it’s a straight asset-for-asset exchange, you won’t have to recognize any gain from the exchange. You’ll take the same “basis” (your cost for tax purposes) in the replacement property that you had in the relinquished property. Even if you don’t have to recognize any gain on the exchange, you still have to report the exchange on a form that is attached to your tax return.

However, the properties often aren’t equal in value, so some cash or other (non-like-kind) property is thrown into the deal. This cash or other property is known as “boot.” If boot is involved, you’ll have to recognize your gain, but only up to the amount of boot you receive in the exchange. In these situations, the basis you get in the like-kind replacement property you receive is equal to the basis you had in the relinquished property you gave up reduced by the amount of boot you received but increased by the amount of any gain recognized.

Here’s an example

Let’s say you exchange land (investment property) with a basis of $100,000 for a building (investment property) valued at $120,000 plus $15,000 in cash. Your realized gain on the exchange is $35,000: You received $135,000 in value for an asset with a basis of $100,000. However, since it’s a like-kind exchange, you only have to recognize $15,000 of your gain: the amount of cash (boot) you received. Your basis in the new building (the replacement property) will be $100,000, which is your original basis in the relinquished property you gave up ($100,000) plus the $15,000 gain recognized, minus the $15,000 boot received.

Note: No matter how much boot is received, you’ll never recognize more than your actual (“realized”) gain on the exchange.

If the property you’re exchanging is subject to debt from which you’re being relieved, the amount of the debt is treated as boot. The theory is that if someone takes over your debt, it’s equivalent to him or her giving you cash. Of course, if the replacement property is also subject to debt, then you’re only treated as receiving boot to the extent of your “net debt relief” (the amount by which the debt you become free of exceeds the debt you pick up).

Like-kind exchanges can be complex but they’re a good tax-deferred way to dispose of investment or trade or business assets. We can answer any additional questions you have or assist with the transaction.

© 2022

The tax obligations if your business closes its doors

- Details

- Published: 12 July 2022 12 July 2022

Sadly, many businesses have been forced to shut down recently due to the pandemic and the economy. If this is your situation, we can assist you, including taking care of the various tax responsibilities that must be met.

Of course, a business must file a final income tax return and some other related forms for the year it closes its doors. The type of return to be filed depends on the type of business you have. Here’s a rundown of the basic requirements.

Sole proprietorships. You’ll need to file the usual Schedule C, “Profit or Loss from Business,” with your individual return for the year you close the business. You may also need to report self-employment tax.

Partnerships. A partnership must file Form 1065, “U.S. Return of Partnership Income,” for the year it closes. You also must report capital gains and losses on Schedule D. Indicate that this is the final return and do the same on Schedule K-1, “Partner’s Share of Income, Deductions, Credits, etc.”

All corporations. Form 966, “Corporate Dissolution or Liquidation,” must be filed if you adopt a resolution or plan to dissolve a corporation or liquidate any of its stock.

C corporations. File Form 1120, “U.S. Corporation Income Tax Return,” for the year you close. Report capital gains and losses on Schedule D. Indicate this is the final return.

S corporations. File Form 1120-S, “U.S. Income Tax Return for an S Corporation,” for the year of closing. Report capital gains and losses on Schedule D. The “final return” box must be checked on Schedule K-1.

All businesses. Other forms may need to be filed to report sales of business property and asset acquisitions if you sell your business.

Employees and contract workers

If you have employees, you must pay them final wages and compensation owed, make final federal tax deposits and report employment taxes. Failure to withhold or deposit employee income, Social Security and Medicare taxes can result in full personal liability for what’s known as the Trust Fund Recovery Penalty.

If you’ve paid any contractors at least $600 during the calendar year in which you close your business, you must report those payments on Form 1099-NEC, “Nonemployee Compensation.”

Other tax issues

If your business has a retirement plan for employees, you’ll want to terminate the plan and distribute benefits to participants. There are detailed notice, funding, timing and filing requirements that must be met by a terminating plan. There are also complex requirements related to flexible spending accounts, Health Savings Accounts, and other programs for your employees.

We can assist you with many other complicated tax issues related to closing your business, including debt cancellation, use of net operating losses, freeing up any remaining passive activity losses, depreciation recapture, and possible bankruptcy issues.

We can advise you on the length of time you need to keep business records. You also must cancel your Employer Identification Number (EIN) and close your IRS business account.

If your business is unable to pay all the taxes it owes, we can explain the available payment options to you. Contact us to discuss these issues and get answers to any questions.

© 2022

How disability income benefits are taxed

- Details

- Published: 08 July 2022 08 July 2022

If you’ve recently begun receiving disability income, you may wonder how it’s taxed. The answer is: It depends.

The key issue is: Who paid for the benefit? If the income is paid directly to you by your employer, it’s taxable to you just as your ordinary salary would be. (Taxable benefits are also subject to federal income tax withholding. However, depending on the employer’s disability plan, in some cases they aren’t subject to Social Security tax.)

Frequently, the payments aren’t made by an employer but by an insurance company under a policy providing disability coverage. In other cases, they’re made under an arrangement having the effect of accident or health insurance. In these cases, the tax treatment depends on who paid for the insurance coverage. If your employer paid for it, then the income is taxed to you just as if it was paid directly to you by the employer. On the other hand, if it’s a policy you paid for, the payments you receive under it aren’t taxable.

Even if your employer arranges for the coverage (in a policy made available to you at work), the benefits aren’t taxed to you if you (and not your employer) pay the premiums. For these purposes, if the premiums are paid by the employer but the amount paid is included as part of your taxable income from work, the premiums will be treated as paid by you. In these cases, the tax treatment of the benefits received depends on the tax treatment of the premiums paid.

Illustrative example

Let’s say Max’s salary is $1,000 a week ($52,000 a year). Additionally, under a disability insurance arrangement made available to him by his employer, $10 a week ($520 annually) is paid on his behalf by his employer to an insurance company. Max includes $52,520 in income as his wages for the year ($52,000 paid to him plus $520 in disability insurance premiums). Under these facts, the insurance is treated as paid for by Max. If he becomes disabled and receives benefits under the policy, the benefits aren’t taxable income to him.

Now assume that Max includes only $52,000 in income as his wages for the year because the amount paid for the insurance coverage qualifies as excludable under the rules for employer-provided health and accident plans. In this case, the insurance is treated as paid for by the employer. If Max becomes disabled and receives benefits under the policy, the benefits are taxable income to him.

There are special rules if there is a permanent loss (or loss of the use) of a member or function of the body or a permanent disfigurement. In these cases, employer disability payments aren’t taxed, as long as they aren’t computed based on amount of time lost from work.

Social Security disability benefits

This discussion doesn’t cover the tax treatment of Social Security disability benefits. They may be taxed to you under the rules that govern Social Security benefits.

Needed coverage

In deciding how much disability coverage you need to protect yourself and your family, take the tax treatment into consideration. If you’re buying the policy yourself, you only have to replace your “after tax” (take-home) income because your benefits won’t be taxed. On the other hand, if your employer is paying for the benefit, keep in mind that you’ll lose a percentage of it to taxes. If your current coverage is insufficient, you may want to supplement the employer benefit with a policy you take out on your own. Contact us if you’d like to discuss this issue.

© 2022

How do taxes factor into an M&A transaction?

- Details

- Published: 06 July 2022 06 July 2022

Although merger and acquisition activity has been down in 2022, according to various reports, there are still companies being bought and sold. If your business is considering merging with or acquiring another business, it’s important to understand how the transaction will be taxed under current law.

Stocks vs. assets

From a tax standpoint, a transaction can basically be structured in two ways:

1. Stock (or ownership interest). A buyer can directly purchase a seller’s ownership interest if the target business is operated as a C or S corporation, a partnership, or a limited liability company (LLC) that’s treated as a partnership for tax purposes.

The current 21% corporate federal income tax rate makes buying the stock of a C corporation somewhat more attractive. Reasons: The corporation will pay less tax and generate more after-tax income than it would have years ago. Plus, any built-in gains from appreciated corporate assets will be taxed at a lower rate when they’re eventually sold.

Under current law, individual federal tax rates are reduced from years ago and may also make ownership interests in S corporations, partnerships and LLCs more attractive. Reason: The passed-through income from these entities also will be taxed at lower rates on a buyer’s personal tax return. However, individual rate cuts are scheduled to expire at the end of 2025, and, depending on future changes in Washington, they could be eliminated earlier or extended.

2. Assets. A buyer can also purchase the assets of a business. This may happen if a buyer only wants specific assets or product lines. And it’s the only option if the target business is a sole proprietorship or a single-member LLC that’s treated as a sole proprietorship for tax purposes.

Note: In some circumstances, a corporate stock purchase can be treated as an asset purchase by making a “Section 338 election.” Ask your tax advisor for details.

What buyers and sellers want

For several reasons, buyers usually prefer to purchase assets rather than ownership interests. Generally, a buyer’s main objective is to generate enough cash flow from an acquired business to pay any acquisition debt and provide an acceptable return on the investment. Therefore, buyers are concerned about limiting exposure to undisclosed and unknown liabilities and minimizing taxes after the deal closes.

A buyer can step up (increase) the tax basis of purchased assets to reflect the purchase price. Stepped-up basis lowers taxable gains when certain assets, such as receivables and inventory, are sold or converted into cash. It also increases depreciation and amortization deductions for qualifying assets.

Meanwhile, sellers generally prefer stock sales for tax and nontax reasons. One of their main objectives is to minimize the tax bill from a sale. That can usually be achieved by selling their ownership interests in a business (corporate stock or partnership or LLC interests) as opposed to selling business assets.

With a sale of stock or other ownership interest, liabilities generally transfer to the buyer and any gain on sale is generally treated as lower-taxed long-term capital gain (assuming the ownership interest has been held for more than one year).

Keep in mind that other issues, such as employee benefits, can also cause unexpected tax issues when merging with, or acquiring, a business.

Get professional advice

Buying or selling a business may be the most important transaction you make during your lifetime, so it’s important to seek professional tax advice as you negotiate. After a deal is done, it may be too late to get the best tax results. Contact us for the best way to proceed in your situation.

© 2022

Vehicle expenses: Can individual taxpayers deduct them?

- Details

- Published: 01 July 2022 01 July 2022

It’s not just businesses that can deduct vehicle-related expenses on their tax returns. Individuals also can deduct them in certain circumstances. Unfortunately, under current law, you may not be able to deduct as much as you could years ago.

For years prior to 2018, miles driven for business, moving, medical and charitable purposes were potentially deductible. For 2018 through 2025, business and moving miles are deductible only in much more limited circumstances. The changes were a result of the Tax Cuts and Jobs Act (TCJA), which could also affect your tax benefit from medical and charitable miles.

Fortunately, if you’re eligible to deduct driving costs, the IRS just increased the standard amounts for the second half of 2022 due to the high price of gas.

Current vs. past limits

Before 2018, if you were an employee, you potentially could deduct business mileage not reimbursed by your employer as a miscellaneous itemized deduction. But the deduction was subject to a 2% of adjusted gross income (AGI) floor, which meant that mileage was deductible only to the extent that your total miscellaneous itemized deductions for the year exceeded 2% of your AGI. However, for 2018 through 2025, you can’t deduct the mileage regardless of your AGI. Why? The TCJA suspends miscellaneous itemized deductions subject to the 2% floor.

If you’re self-employed, business mileage can be deducted from self-employment income. Therefore, it’s not subject to the 2% floor and is still deductible for 2018 through 2025, as long as it otherwise qualifies.

Miles driven for a work-related move prior to 2018 were generally deductible “above the line” (that is, itemizing wasn’t required to claim the deduction). But for 2018 through 2025, under the TCJA, moving expenses are deductible only for active-duty members of the military.

Miles driven for health-care-related purposes are deductible as part of the medical expense itemized deduction. For example, you can include in medical expenses the amounts paid when you use a car to travel to doctors’ appointments. For 2022, medical expenses are deductible to the extent they exceed 7.5% of your AGI.

The limits for deducting expenses for charitable miles driven haven’t changed, but keep in mind that the charitable driving deduction can only be claimed if you itemize. For 2018 through 2025, the standard deduction has been nearly doubled so not as many taxpayers are itemizing. Depending on your total itemized deductions, you might be better off claiming the standard deduction, in which case you’ll get no tax benefit from your charitable miles (or from your medical miles, even if you exceed the AGI floor).

Different mileage rates

Rather than keeping track of your actual vehicle expenses, you can use a standard mileage rate to compute your deductions. The 2022 rates vary depending on the purpose:

- Business. 62.5 cents for July 1 to December 31, 2022, and 58.5 cents for January 1 to June 30, 2022.

- Medical. 22 cents for July 1 to December 31, 2022, and 18 cents for January 1 to June 30, 2022.

- Moving for active-duty military. 22 cents for July 1 to December 31, 2022, and 18 cents for January 1 to June 30, 2022.

- Charitable. 14 cents.

In addition to deductions based on the standard mileage rate, you may deduct related parking fees and tolls. There are also substantiation requirements, which include tracking miles driven.

Get help

Do you have questions about deducting vehicle-related expenses? Contact us. We can help you with your tax planning.

© 2022

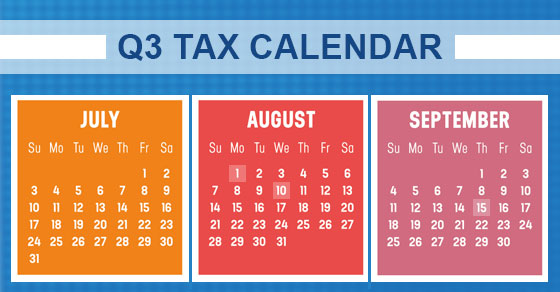

2022 Q3 tax calendar: Key deadlines for businesses and other employers

- Details

- Published: 29 June 2022 29 June 2022

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

August 1

- Report income tax withholding and FICA taxes for second quarter 2022 (Form 941), and pay any tax due. (See the exception below, under “August 10.”)

- File a 2021 calendar-year retirement plan report (Form 5500 or Form 5500-EZ) or request an extension.

August 10

- Report income tax withholding and FICA taxes for second quarter 2022 (Form 941), if you deposited on time and in full all of the associated taxes due.

September 15

- If a calendar-year C corporation, pay the third installment of 2022 estimated income taxes.

- If a calendar-year S corporation or partnership that filed an automatic six-month extension:

- File a 2021 income tax return (Form 1120S, Form 1065 or Form 1065-B) and pay any tax, interest and penalties due.

- Make contributions for 2021 to certain employer-sponsored retirement plans.

© 2022

Five tax implications of divorce

- Details

- Published: 24 June 2022 24 June 2022

Are you in the early stages of divorce? In addition to the tough personal issues that you’re dealing with, several tax concerns need to be addressed to ensure that taxes are kept to a minimum and that important tax-related decisions are properly made. Here are five issues to consider if you’re in the process of getting a divorce.

- Alimony or support payments. For alimony under divorce or separation agreements that are executed after 2018, there’s no deduction for alimony and separation support payments for the spouse making them. And the alimony payments aren’t included in the gross income of the spouse receiving them. (The rules are different for divorce or separation agreements executed before 2019.)

- Child support. No matter when the divorce or separation instrument is executed, child support payments aren’t deductible by the paying spouse (or taxable to the recipient).

- Personal residence. In general, if a married couple sells their home in connection with a divorce or legal separation, they should be able to avoid tax on up to $500,000 of gain (as long as they’ve owned and used the residence as their principal residence for two of the previous five years). If one spouse continues to live in the home and the other moves out (but they both remain owners of the home), they may still be able to avoid gain on the future sale of the home (up to $250,000 each), but special language may have to be included in the divorce decree or separation agreement to protect this tax exclusion for the spouse who moves out.

If the couple doesn’t meet the two-year ownership and use tests, any gain from the sale may qualify for a reduced exclusion due to unforeseen circumstances. - Pension benefits. A spouse’s pension benefits are often part of a divorce property settlement. In these cases, the commonly preferred method to handle the benefits is to get a “qualified domestic relations order” (QDRO). This gives one spouse the right to share in the pension benefits of the other and taxes the spouse who receives the benefits. Without a QDRO the spouse who earned the benefits will still be taxed on them even though they’re paid out to the other spouse.

- Business interests. If certain types of business interests are transferred in connection with divorce, care should be taken to make sure “tax attributes” aren’t forfeited. For example, interests in S corporations may result in “suspended” losses (losses that are carried into future years instead of being deducted in the year they’re incurred). When these interests change hands in a divorce, the suspended losses may be forfeited. If a partnership interest is transferred, a variety of more complex issues may arise involving partners’ shares of partnership debt, capital accounts, built-in gains on contributed property, and other complex issues.

A variety of other issues

These are just some of the issues you may have to deal with if you’re getting a divorce. In addition, you must decide how to file your tax return (single, married filing jointly, married filing separately or head of household). You may need to adjust your income tax withholding and you should notify the IRS of any new address or name change. There are also estate planning considerations. We can help you work through all of the financial issues involved in divorce.

© 2022

Businesses will soon be able to deduct more under the standard mileage rate

- Details

- Published: 22 June 2022 22 June 2022

Business owners are aware that the price of gas is historically high, which has made their vehicle costs soar. The average nationwide price of a gallon of unleaded regular gas on June 17 was $5, compared with $3.08 a year earlier, according to the AAA Gas Prices website. A gallon of diesel averaged $5.78 a gallon, compared with $3.21 a year earlier.

Fortunately, the IRS is providing some relief. The tax agency announced an increase in the optional standard mileage rate for the last six months of 2022. Taxpayers may use the optional cents-per-mile rate to calculate the deductible costs of operating a vehicle for business.

For the second half of 2022 (July 1–December 31), the standard mileage rate for business travel will be 62.5 cents per mile, up from 58.5 cents per mile for the first half of the year (January 1–June 30). There are different standard mileage rates for charitable and medical driving.

Special situation

Raising the standard mileage rate in the middle of the year is unusual. Normally, the IRS updates the mileage rates once a year at the end of the year for the next calendar year. However, the tax agency explained that “in recognition of recent gasoline price increases, the IRS made this special adjustment for the final months of 2022.” But while the move is uncommon, it’s not without precedent. The standard mileage rate was increased for the last six months of 2011 and 2008 after gas prices rose significantly.

While fuel costs are a significant factor in the mileage figure, the IRS notes that “other items enter into the calculation of mileage rates, such as depreciation and insurance and other fixed and variable costs.”

Two options

The optional standard mileage rate is one of two methods a business can use to compute the deductible costs of operating an automobile for business puroses. Taxpayers also have the option of calculating the actual costs of using their vehicles rather than using the standard mileage rate. This may include expenses such as gas, oil, tires, insurance, repairs, licenses, vehicle registration fees and a depreciation allowance for the vehicle.

From a tax standpoint, you may get a larger deduction by tracking the actual expense method than you would with the standard mileage rate. But many taxpayers don’t want to spend time tracking actual costs. Be aware that there are rules that may prevent you from using one method or the other. For example, if a business wants to use the standard mileage rate for a car it leases, the business must use this rate for the entire lease period. Consult with us about your particular circumstances to determine the best course of action.

© 2022

Your estate plan: Don’t forget about income tax planning

- Details

- Published: 16 June 2022 16 June 2022

As a result of the current estate tax exemption amount ($12.06 million in 2022), many people no longer need to be concerned with federal estate tax. Before 2011, a much smaller amount resulted in estate plans attempting to avoid it. Now, because many estates won’t be subject to estate tax, more planning can be devoted to saving income taxes for your heirs.

Note: The federal estate tax exclusion amount is scheduled to sunset at the end of 2025. Beginning on January 1, 2026, the amount is due to be reduced to $5 million, adjusted for inflation. Of course, Congress could act to extend the higher amount or institute a new amount.

Here are some strategies to consider in light of the current large exemption amount.

Gifts that use the annual exclusion

One of the benefits of using the gift tax annual exclusion to make transfers during life is to save estate tax. This is because both the transferred assets and any post-transfer appreciation generated by those assets are removed from the donor’s estate.

As mentioned, estate tax savings may not be an issue because of the large estate exemption amount. Further, making an annual exclusion transfer of appreciated property carries a potential income tax cost because the recipient receives the donor’s basis upon transfer. Thus, the recipient could face income tax, in the form of capital gains tax, on the sale of the gifted property in the future. If there’s no concern that an estate will be subject to estate tax, even if the gifted property grows in value, then the decision to make a gift should be based on other factors.

For example, gifts may be made to help a relative buy a home or start a business. But a donor shouldn’t gift appreciated property because of the capital gains that could be realized on a future sale by the recipient. If the appreciated property is held until the donor’s death, under current law, the heir will get a step-up in basis that will wipe out the capital gains tax on any pre-death appreciation in the property’s value.

Spouse’s estate

Years ago, spouses often undertook complicated strategies to equalize their estates so that each could take advantage of the estate tax exemption amount. Generally, a two-trust plan was established to minimize estate tax. “Portability,” or the ability to apply the decedent’s unused exclusion amount to the surviving spouse’s transfers during life and at death, became effective for estates of decedents dying after 2010. As long as the election is made, portability allows the surviving spouse to apply the unused portion of a decedent’s applicable exclusion amount (the deceased spousal unused exclusion amount) as calculated in the year of the decedent’s death. The portability election gives married couples more flexibility in deciding how to use their exclusion amounts.

Estate or valuation discounts

Be aware that some estate exclusion or valuation discount strategies to avoid inclusion of property in an estate may no longer be worth pursuing. It may be better to have the property included in the estate or not qualify for valuation discounts so that the property receives a step-up in basis. For example, the special use valuation — the valuation of qualified real property used for farming or in a business on the basis of the property’s actual use, rather than on its highest and best use — may not save enough, or any, estate tax to justify giving up the step-up in basis that would otherwise occur for the property.

Contact us if you want to discuss these strategies and how they relate to your estate plan.

© 2022